Last week I was asked a very common question:

Do you happen to have any tool that tries to triangulate if {Mobile App X} is maintaining their ad spend?

But it's a surprisingly difficult one to answer! I have not yet come across a truly reliable third-party estimate of spend for specific mobile app advertisers (if anyone HAS please let me know!).

Just to be sure, I posed this same question to my team and on Eric Seufert's Mobile Dev Memo Slack, which is easily the best community for mobile growth around (save, of course, for MAU Vegas in person). In addition to Eric, two other industry titans weighed in: Thomas Petit + 🕺🏻 Matej Lancaric (not to mention some thumbs up from a number of other sharp folks, including my friend Shamanth M. Rao).

The general consensus was as follows:

- No third-party tool was trustworthy with respect to spend estimates (though some have other great features like creative databases etc.)

- The volume of new creative flights on Facebook (via the Ads Library) is a good proxy

- Installs per day is a good proxy (via Sensor Tower/Mobile Action/Data.ai etc.)

- The number of creatives live + number of ad networks live (via Sensor Tower/Mobile Action/Data.ai etc.) were good proxies

For the purposes of demonstration, I'm going to pull the numbers for the Mercari app in the US.

Facebook Ads Library

In theory, Facebook's Ads Library reports on both Active and Inactive ads and includes the dates the ads were active.

According to the Ads Library, Mercari didn't launch anything between July 2020 and Oct 2022. That's obviously extremely unlikely. For Mercari, we see 10 launches in October, and 43 in November. Were I to repeat this exercise I wouldn't even bother pulling the Ads Library data.

Number of Creatives Live (via Mobile Action)

We are power users of MobileAction's tools, including their Ad Intelligence module/plan. This is an example of the overview from a Creative Analysis page for an app:

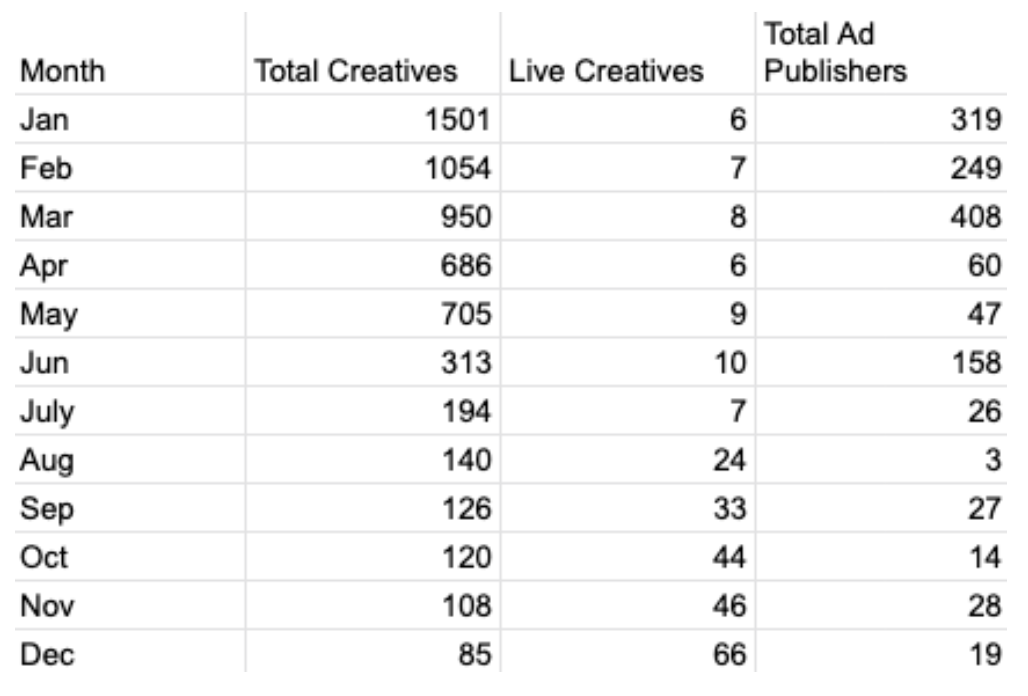

I first pulled the total creatives/live creatives/ad publishers data by month for the iOS app. That suggests a significant ramp-down over the course of 2022:

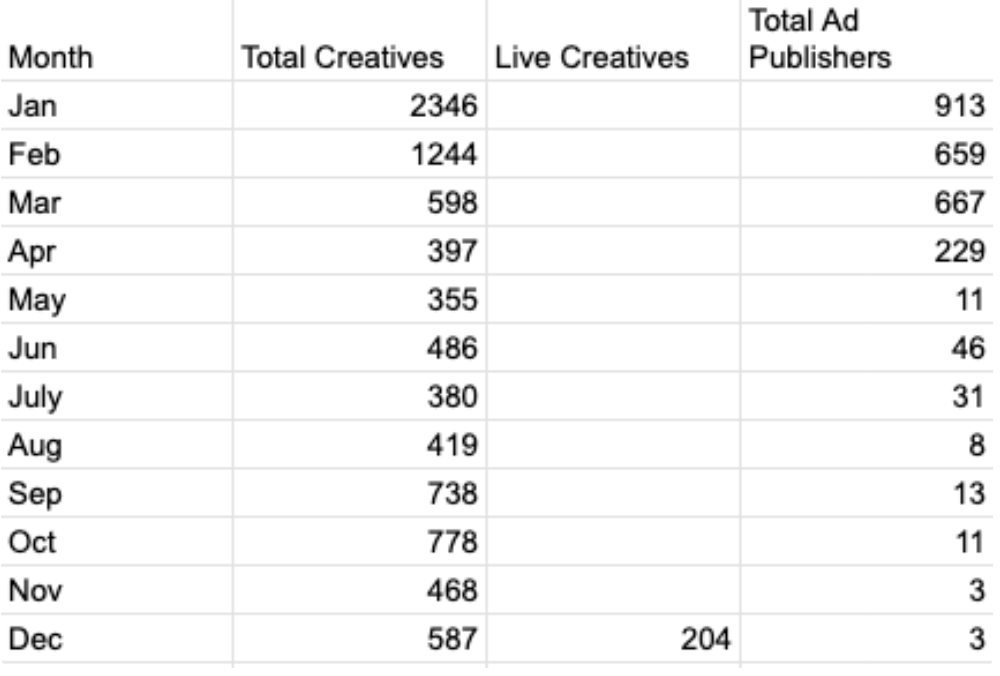

And it looks the same for the Android app:

Number of Ad Networks Live (via Mobile Action)

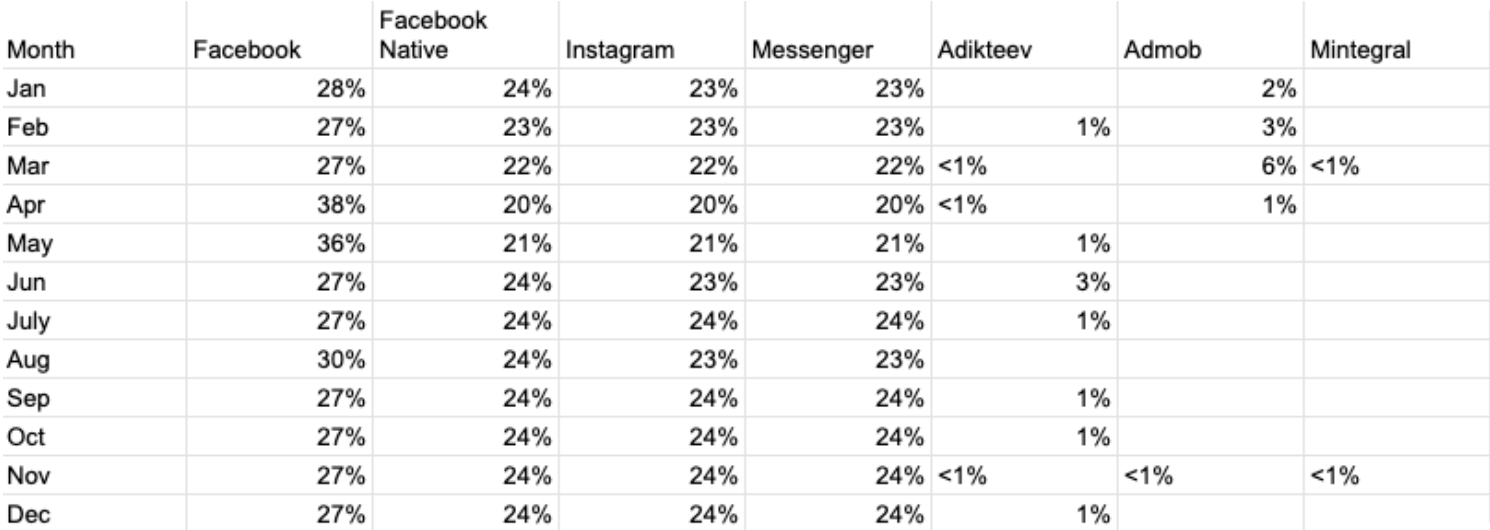

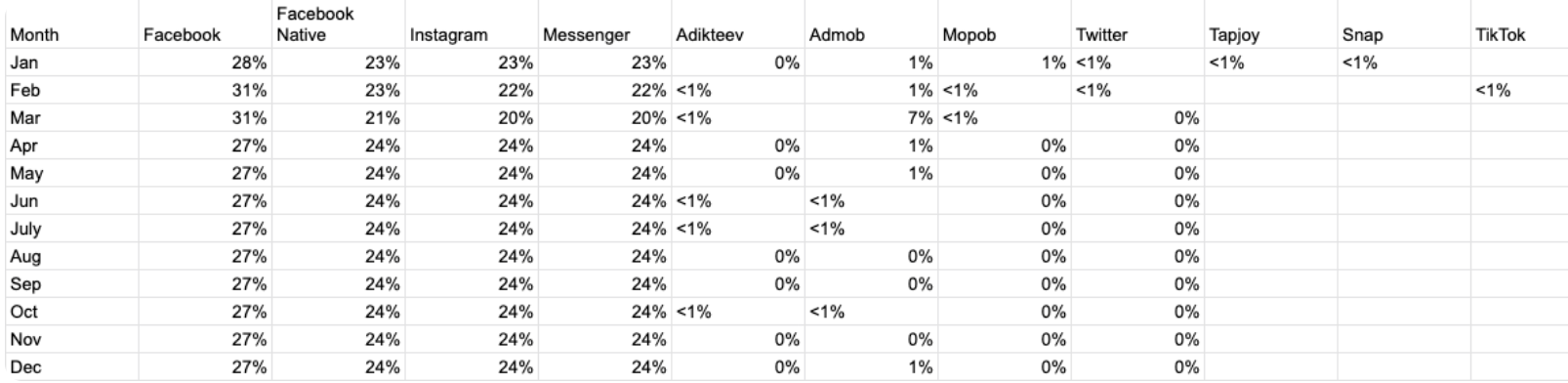

Mobile Action also features an Ad Network Distribution report (based on either the number of creatives or impressions). I pulled the data by month based on impressions. This is for the Mercari iOS app. This data doesn't really suggest much of a pullback.

And again this is for the Android app (notably a number of small channels fall out of the mix after Q1 according to Mobile Action):

Installs Per Day

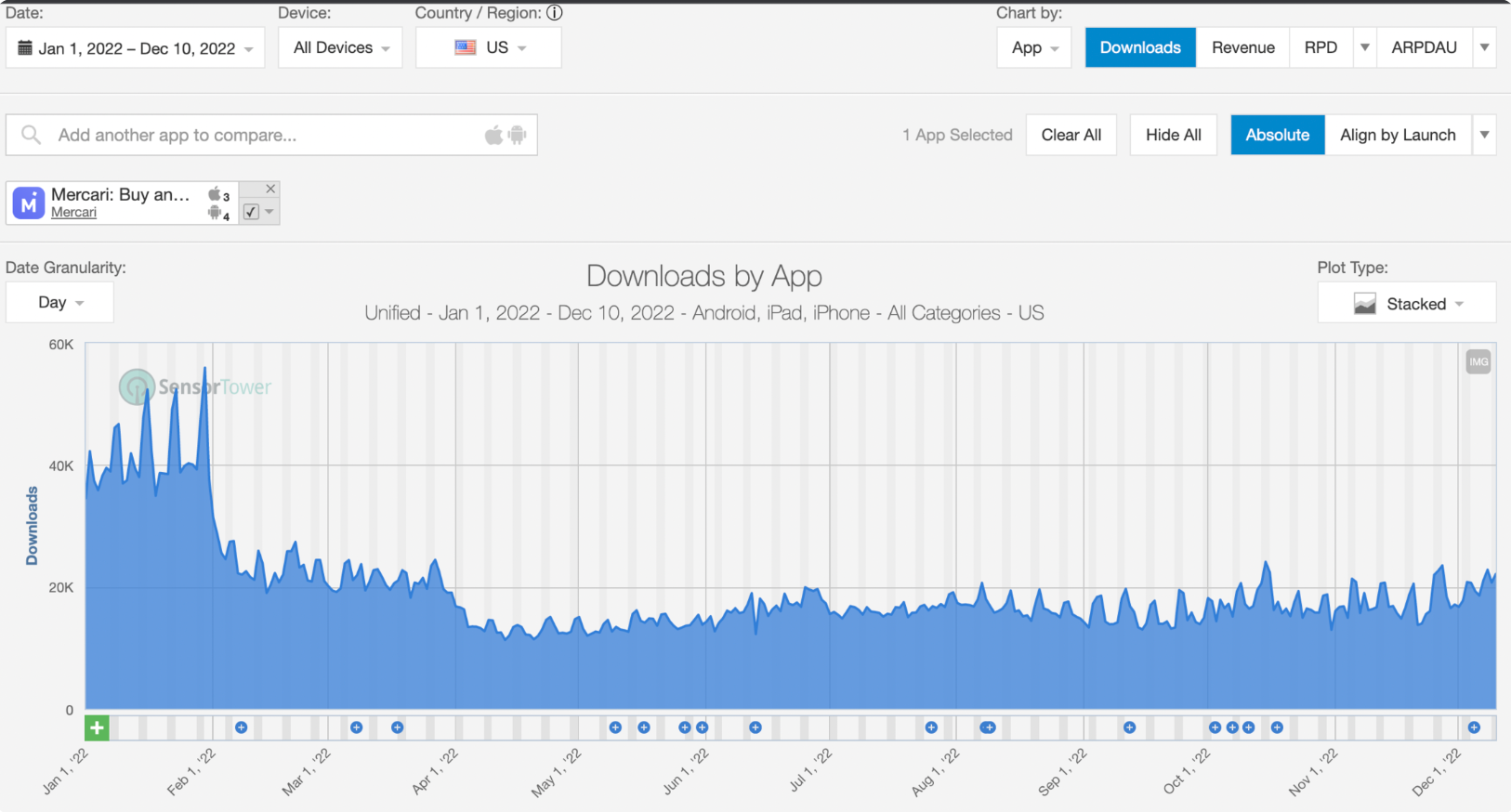

Last but certainly not least I checked the regular old downloads data in both SensorTower and appfigures. Below shows data combined iOS + Android downloads by day via SensorTower.

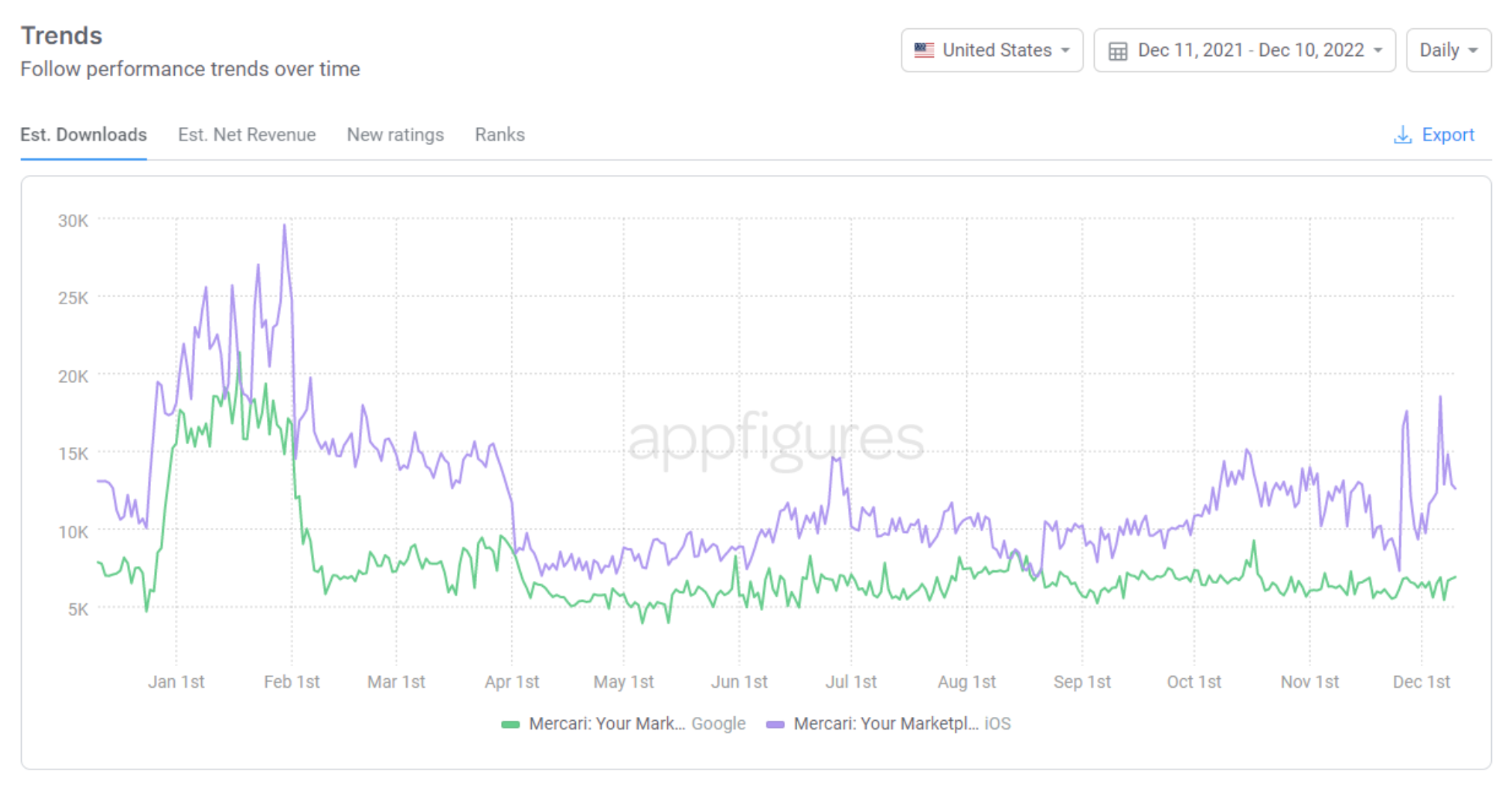

And here is the same via appfigures.

In conclusion

The Mobile Action creative + network data does seem to line up pretty neatly with the downloads by day from both ST and appfigures. The FB Ads Library data seemed really unreliable (especially in comparison to what Mobile Action was reporting).

In the end, it does seem like Mercari pulled back meaningfully after Q1!

PS: Huge thanks to Matej, Thomas, Eric, Shamanth and for their help and insights here!