The Goal

A wellness and self-care app with 1.2 million users worldwide came to us for paid acquisition help. After building a strong following on TikTok, the brand needed more success scaling paid channels including SEM and additional paid social channels. The client's goal was to increase high-value Trials, ultimately converting to subscriptions.

The Strategy

Because a high volume of App Trials with low Customer Acquisition Costs is a strong predictor of subscribers, revenue, and long-term value, we began by focusing on growing App Trials. We worked as an extension of the client’s marketing team to provide paid acquisition and technology solutions, uncovering campaign efficiencies and working toward an increase in Trials.

Auditing Existing Efforts

We identified critical measurement gaps and misaligned spending on iOS vs Android and Display vs Search. We also uncovered opportunities to better set up the campaigns for long-term success.

Targeting Immediate New User Acquisition and Laying the Groundwork for Long-Term Value

Our high-level approach was to drive higher quality customers via install growth in Q1, laying the groundwork to scale Trials efficiently in Q2-Q4. To do this, we incorporated end-to-end event tracking in all ad channels to set the stage for a future switch to optimizing for Trials and Cost Per Trial. We tested a variety of Google campaign optimization settings to take advantage of the data available, and for both iOS and Android, optimizing for App Installs ultimately generated a lower Cost per Trial than optimizing for App Trials. Building on these early successes, we were well-positioned to focus on efficient Trial growth in Q2 and H2 of 2022.

The Results

- The key finding was that the iOS Average Revenue per User (ARPU) was 36% higher and converted to Subscribers at a higher rate than Android. These insights allowed the client to drive significant volume increases by prioritizing iOS product and marketing efforts.

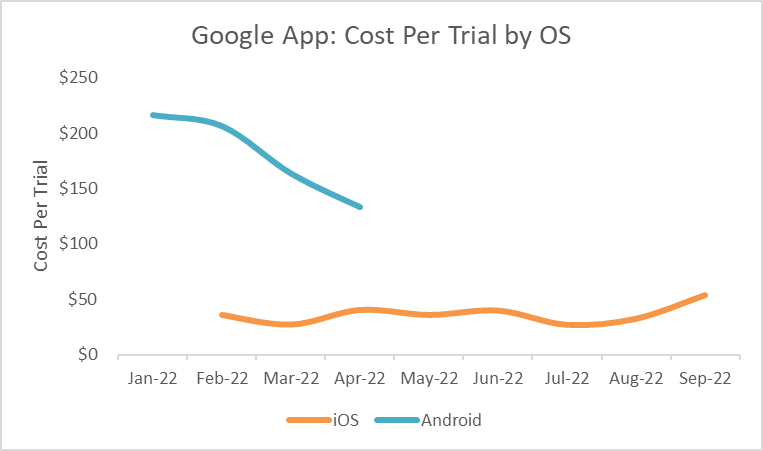

- From Q1 to Q2, Android’s Cost per Trial improved by -33% quarter over quarter due to better optimization.

- iOS also significantly outperformed Android’s Cost per Trial with an 85% lower Cost per Trial than Android in Q1. As a result, the Android budget was shifted to iOS in Q2 and Q3.

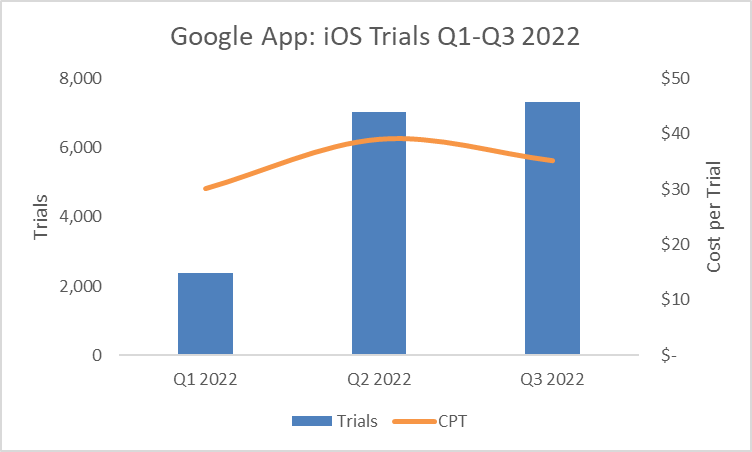

- iOS investment increased with 2x more Trials from Q1 to Q2. Impressively, iOS still drove 4% more Trials in Q3 at a 9.7% lower Cost per Trial.

iOS 14+ and SKAN presented user acquisition challenges due to tracking limitations, but iOS remains a big opportunity to acquire high-value users. Apple’s SKAD Network (SKAN) attribution windows are currently capped at three days, so a significant portion of Trials was missing if they occurred later. To solve this challenge, we compared attribution sources and supplemented SKAN data with modeled iOS conversions in Google Ads. This revealed that iOS Trial data on Google App showed delays of up to 30 days, which Apple’s SKAN would miss. This led us to develop a custom latency model to estimate the true impact of Google iOS campaigns to project Trials into Subscribers and Revenue.

Advertising in the privacy-focused iOS landscape presents some challenges, but with a strong measurement strategy and creativity, iOS remains a strong acquisition source with high opportunity. Looking to the future, we're optimistic that SKAN 4.0 and future iOS releases paired with the right creative approach and marketing expertise will continue to increase opportunities for iOS to drive performance.